Logistics Insurance Guide for Smart Business Choices

You want to make smart choices for your business. Picking the right logistics insurance policy can protect your goods, your money, and your reputation. Every business faces different risks. You need to understand your operations, the type of goods you ship, and the regions where you work. Insurance helps you manage challenges like cargo theft and damage, accidents, and meeting rules in different places. The logistics insurance guide helps you see how these factors matter for your business.

Cargo theft and damage can cost you money.

Accidents and liability may lead to big losses.

Regulatory compliance keeps you safe from penalties.

Key Takeaways

Understand your business risks before choosing logistics insurance. Identify common risks like theft, accidents, and regulatory issues.

Evaluate your operations and the type of goods you ship. Different businesses have unique insurance needs based on their activities and locations.

Choose the right type of coverage. Options include cargo insurance, liability insurance, and freight insurance, each serving different purposes.

Regularly review your insurance policy. Changes in your business can affect your coverage needs, so stay proactive in updating your policy.

Consult a knowledgeable insurance broker. They can help you navigate options and find the best coverage for your specific logistics needs.

Logistics Insurance Guide: Assessing Your Risks

Identify Common Logistics Risks

You need to know the risks that can affect your business before you choose an insurance policy. Many companies in transportation and supply chain face similar challenges. Some risks happen often and can cause big problems for your goods and your money.

Accidents and collisions can damage vehicles and cargo.

Infrastructure wear and tear leads to delays and extra costs.

Environmental hazards, like storms or floods, disrupt supply chains.

Cybersecurity threats can harm your data and operations.

Regulatory and compliance challenges may result in fines or business interruptions.

Transportation delays slow down deliveries and upset customers.

Regulatory noncompliance can bring penalties.

Security breaches in cargo handling can lead to theft or loss.

Cargo theft and damage happen often, especially in busy logistics hubs. Criminals use new methods to steal goods, so you must stay alert. Even with safety measures, theft and loss can still occur. You need to understand these risks to make smart choices with the logistics insurance guide.

Tip: Make a list of the risks your business faces most often. This helps you see where you need the most protection.

Evaluate Your Operations

Your business operations shape your insurance needs. Small and medium-sized companies have different risks than large ones. You must look at what you do every day and how it affects your risk level.

Type of business and industry changes your risk profile.

Your business location can increase or decrease risks.

Coverage types must match your operations.

Policy limits and deductibles affect your costs and protection.

Business size matters for the amount of coverage you need.

Claims history can change your insurance options.

External factors, like geopolitical tensions or natural disasters, may impact your business.

Customer expectations for fast service put pressure on your operations.

Fuel and insurance costs can change quickly.

Managing costs with little room for error is important.

You should review your operations often. If your business grows or changes, your risks may change too. The logistics insurance guide helps you match your coverage to your business needs.

Analyze Goods and Regions

The type of goods you ship and the regions you serve affect your risk profile. Some items need more protection than others. Where you send your goods also matters.

Factor | Description |

|---|---|

Higher-value shipments usually need higher premiums because they have more risk of loss or damage. | |

Nature of the Cargo | Fragile, perishable, or hazardous items need special coverage and often cost more to insure. |

Shipping Mode | Air, sea, rail, and road each have unique risks that affect insurance costs. |

Destination and Route | Shipments through high-risk areas or busy routes face higher premiums and more risk. |

You must think about what you ship and where you ship it. If you send goods through risky areas or handle fragile items, you need stronger coverage. The logistics insurance guide helps you look at these details so you can protect your business.

Note: Review your goods and shipping routes every year. Changes in value or destination can change your insurance needs.

Types of Logistics Insurance Coverage

Choosing the right insurance starts with knowing the main types of coverage. Each type protects your business in different ways. The logistics insurance guide helps you see which options fit your needs.

Cargo Insurance

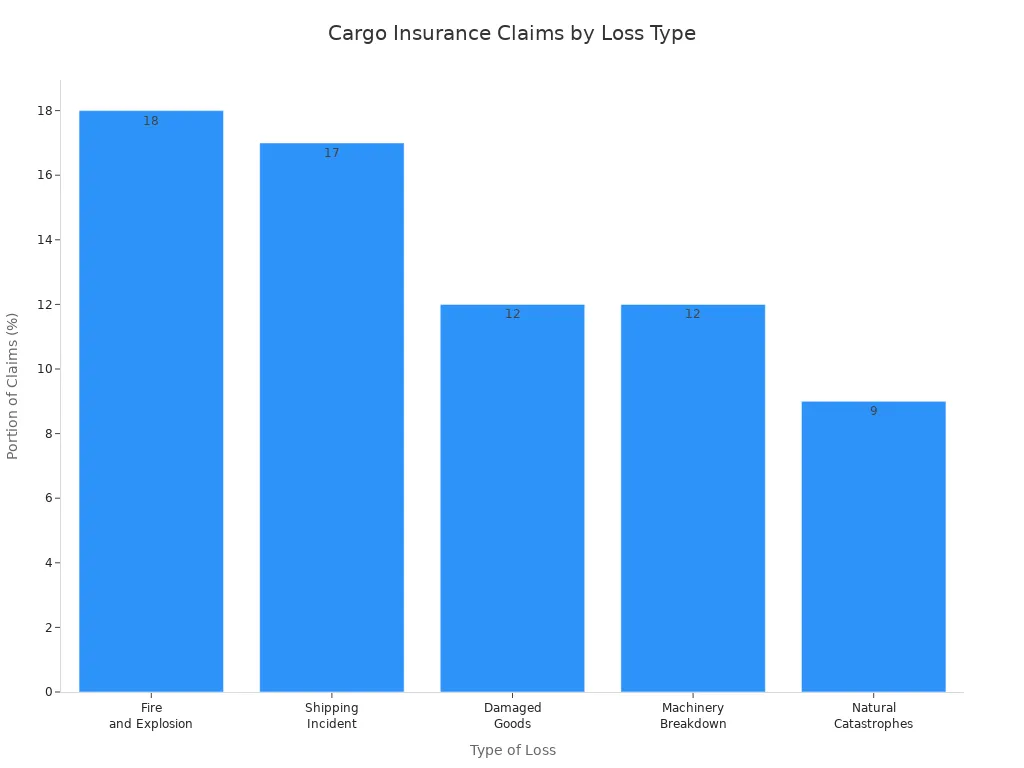

Cargo insurance protects your goods while they move from one place to another. It covers loss, damage, or theft during shipping. Many risks can affect your cargo, such as fire, accidents, or storms. The table below shows the most common reasons for cargo insurance claims in international shipping.

Claim by Loss | Portion of Claims |

|---|---|

Fire and Explosion | 18% |

Shipping Incident (Collision, Sinking, etc.) | 17% |

Damaged Goods (Including Handling/Storage) | 12% |

Machinery Breakdown (including engine failure) | 12% |

Natural Catastrophes (hurricanes, storms, floods, wildfires) | 9% |

You need cargo insurance if you ship valuable, fragile, or perishable goods. This coverage gives you peace of mind when your products are on the move.

Liability Insurance

Liability insurance protects you if someone claims injury or property damage because of your business. This is a basic need for logistics companies. It covers accidents during transportation and warehousing. You may also need extra coverage for special risks. The table below explains the main types of liability insurance for logistics.

Coverage Type | Description |

|---|---|

Cargo Liability | Covers legal responsibility for cargo damage under shipping documents. |

Contingent Cargo | Protects against damage to customers’ cargo handled by another carrier. |

Contingent Auto / Freight Broker | Pays for legal defense and third-party injury or property damage. |

Errors & Omissions (E&O) | Covers financial loss from mistakes in logistics duties. |

General Liability | Pays for injury or property damage to others from your business operations. |

Optional Coverage Enhancements | Adds extra protection, such as pollution coverage or additional insured parties. |

Tip: Liability insurance often includes coverage for medical payments and completed operations. It can also protect you from claims about your advertising.

Freight Insurance

Freight insurance covers the carrier or freight forwarder. It protects you if you are responsible for moving goods and something goes wrong. This insurance is different from cargo insurance. The table below shows the main differences.

Aspect | Cargo Insurance | Freight Insurance |

|---|---|---|

Purpose | Protects the owner of the goods during transit. | Protects the carrier or forwarder from liability. |

Coverage Scope | Covers all risks to goods. | Covers liability from carrier’s mistakes. |

Claims Calculation | Based on the value of the goods. | Based on the weight of the goods. |

Proof of Negligence | Not needed for claims. | Needed for claims. |

You should choose freight insurance if you handle shipping for others and want to protect your business from claims.

Additional Coverages

Some businesses need more protection. Extra coverages help you handle special risks. For example, errors and omissions insurance pays for legal costs if you make a mistake in your work. Cyber liability insurance protects you if someone hacks your data or causes a data breach. Other options include:

Extra Expense Coverage: Pays for extra costs to keep your business running during repairs.

Business Interruption Insurance: Covers lost revenue if your business stops working.

Errors and Omissions Insurance: Protects against claims of mistakes or oversights.

Cyber Liability Insurance: Shields your business from data breaches and technology risks.

The logistics insurance guide recommends reviewing these options if your business uses technology or handles complex shipments.

Set Coverage Needs

Match Coverage to Risks

You need to match your insurance coverage to the risks your business faces. Every company has different threats. You must look at your operations and decide what could go wrong. Use these steps to help you choose the right coverage:

Description | |

|---|---|

Threat assessment | Check how likely it is for a problem to happen. |

Risk probability | Decide how often a risk could affect your business. |

Risk severity | Think about how bad the damage could be. |

Cost of risk | Estimate how much money you could lose if something happens. |

Analytics, reporting | Use data and reports to see patterns and make smart choices. |

You should work with an insurance broker who knows the logistics industry. Brokers help you find coverage that fits your business. There is no one-size-fits-all solution. You need a plan that matches your risks. Talk with your broker and share details about your business. Good communication helps you get the right protection.

Tip: Review your licenses, transportation documents, and contracts. These details help you and your broker build a policy that covers your real risks.

Decide on Limits and Deductibles

Insurance limits and deductibles decide how much protection you get and how much you pay out of pocket. You must choose limits that cover your highest risks. Think about the value of your cargo and the routes you use. Pick a deductible that your business can afford.

Cargo value: Look at the highest value of goods you ship. Set your cargo limits to cover this amount.

Risk exposure: Check your shipping routes. Some areas have more risk. Set liability limits to match these risks.

Financial stability: Choose a deductible that your business can pay if something goes wrong.

Regulatory requirements: Make sure your policy meets the minimum limits set by law.

Deductibles come in different types. You may see these options:

Per shipment deductibles: You pay a set amount for each claim.

Annual aggregate deductibles: You pay up to a total amount for all claims in a year.

Mode-specific deductibles: The deductible changes based on how you ship your goods.

Note: Review your limits and deductibles every year. Your business may grow or change, so your coverage needs may change too.

Review Policy Exclusions

Policy exclusions are rules that say what your insurance does not cover. You must read these carefully. Some exclusions are common in logistics insurance. If you miss these, you may not get paid when you make a claim.

Exclusion Type | Description |

|---|---|

Inherent Vice | Damage caused by the nature of the product itself. |

Latent Defect | Damage due to poor quality of goods. |

Loss Due to Improper Packaging | Damage from bad packaging or crating. |

Willful Misconduct By Assured | Damage from intentional bad actions or fraud. |

Unexplained Loss Or Shortage | Goods disappear or get stolen from your vehicle. |

Other exclusions may include:

Hauling hazardous materials

Driving too far from the driver’s home base

Driving too many miles in one day

Using certain types of roads

Using an unlicensed or uninsured driver

Transporting cargo for hire

Operating outside the U.S.

Exceeding the load limit

Driving recklessly or not taking care of the truck or cargo

Alert: Always check the exclusions before you sign your policy. If you do not understand something, ask your broker for help.

The logistics insurance guide helps you see why matching coverage to risks, setting the right limits, and checking exclusions are key steps. You protect your business when you pay attention to these details.

Compare Providers and Policies

Choosing the right logistics insurance provider helps you protect your business. You need to compare providers and policies to find the best fit for your needs.

Provider Reputation

You should look at the reputation of each insurance provider. A strong reputation means you can trust the provider to handle your claims and support your business. Use the table below to see what matters most when you check a provider’s reputation:

Criteria | Description |

|---|---|

Security Capabilities | Does the provider track freight and use good visibility technology? |

Transparency | Does the provider share information openly and quickly? |

Information Management | Does the provider manage delivery and customer data well? |

Delivery Metrics | Does the provider deliver on time and with accuracy? |

Overall Reputation | What do other businesses and clients say about the provider? |

Tip: Ask other business owners about their experiences with different providers. Reviews and industry ratings help you make smart choices.

Policy Terms and Exclusions

You need to read the policy terms and exclusions carefully. Each provider offers different coverage details. Some policies may not cover certain risks or may have strict rules. Always check what is included and what is left out. If you do not understand something, ask your broker for help.

Look for clear language in the policy.

Check for exclusions that could affect your business.

Make sure the coverage matches your risks.

Premiums and Costs

Insurance costs can change from one provider to another. You should compare premiums and see what you get for your money. Lower premiums may mean less coverage or higher deductibles. Balance cost with the protection you need.

Ask for quotes from several providers.

Compare coverage limits and deductibles.

Watch for hidden fees or extra charges.

Claims and Customer Service

Fast claims processing and strong customer service help you recover quickly after a loss. Some providers offer 24/7 claims support and digital tools for easy management. The table below shows how top providers handle claims and customer service:

Provider | Customer Service Strengths | |

|---|---|---|

Progressive | 24/7 claims processing, same-day certificate issuance | Quick contract turnarounds |

GEICO Commercial | Digital claim reports, real-time policy management | Reduces claim processing time by up to 40% |

State Farm | N/A | N/A |

Note: Work with a broker who understands logistics insurance. A good broker helps you compare providers and find the best policy for your business.

Avoid Common Mistakes

Overlooking Exclusions

You might think your insurance covers every risk, but exclusions can leave you exposed. Insurance policies often list what they do not cover. If you miss these details, you could face big losses when you file a claim. For example, some policies do not cover damage from poor packaging or certain types of cargo. Always read the exclusions before you sign. If you do not understand a term, ask your broker for help.

Tip: Make a checklist of common exclusions. Review this list every time you look at a new policy.

Underinsuring or Overinsuring

Getting the right amount of coverage protects your business and your budget. If you underinsure, you may not have enough money to cover a loss. If you overinsure, you pay more than you need. Both mistakes can hurt your business.

Rising coverage requirements for heavy vehicles can lead to underinsurance if you do not adjust your insurance structure.

Tailoring your insurance policy to match the actual value of your assets helps you avoid overinsuring, which can inflate your operational costs.

You should review your assets and risks often. Adjust your coverage as your business changes. This keeps your protection and costs in balance.

Not Reviewing Policies Regularly

Your business changes over time. You might add new vehicles, hire more drivers, or expand to new locations. If you do not review your insurance policy, you could miss important updates. Regular reviews help you stay protected and compliant.

Interval/Circumstance | Description |

|---|---|

Upon regular renewals | Review options at 6- or 12-month terms, even if coverage needs haven't changed. |

After purchasing new vehicles | New vehicles change coverage needs; they must be listed and may require higher limits. |

Following new hires | Adding drivers means you need to check that all operators are covered. |

In response to operational adjustments | Changes in business operations, like new services or locations, require a review of coverage. |

After legislative changes | Stay compliant with any new laws affecting commercial auto insurance coverage. |

Alert: Set reminders to review your policy at least twice a year or after any big change in your business.

Maintain and Update Your Policy

Consult a Logistics Insurance Broker

A logistics insurance broker helps you make smart choices for your business. You need a broker who understands the risks in freight and logistics. Look for someone with the right skills and certifications. A good broker should:

Know about cargo insurance, auto liability, and errors & omissions insurance.

Work with experienced insurance agents.

Understand risk management for logistics companies.

Hold essential certifications and a clear business plan.

Register for a USDOT number and have a surety bond.

Tip: Ask your broker about their experience with businesses like yours. The right broker gives you advice that fits your needs.

Review Coverage as Business Grows

Your business will change over time. You might add new trucks, offer new services, or use new technology. You must review your insurance coverage as you grow. Midwest Logistics Solutions (MLS) shows how this works. They reviewed their insurance every six months as they grew fast. They increased coverage for a bigger fleet, added special cargo insurance for temperature-controlled goods, and improved cyber liability protection. This helped them handle a $2.5 million claim and $750,000 in business interruption costs after a cyberattack.

You can follow these steps to adjust your coverage:

Meet with your broker to assess new risks.

Collect data on sales and changes in your business.

Get quotes from different insurers for new coverage.

Add new policies in steps as your business grows.

Note: Regular reviews keep your coverage up to date and protect your business from new risks.

Monitor Operational Changes

You need to watch for changes in your daily operations. New routes, more drivers, or new types of cargo can all affect your insurance needs. Review your policy language every year to make sure it matches your current business. If you change how you operate, update your insurance right away.

Annual policy reviews help you stay protected.

Quick updates after changes keep your coverage strong.

Alert: Never wait until after a loss to update your policy. Stay ahead by checking your coverage as soon as your business changes.

You can make smart choices for your logistics insurance by following key steps. Use the table below to guide your decisions:

Key Consideration | Description |

|---|---|

Policy Scope | Cover damage, stock loss, liability, and equipment breakdowns. |

Claim Process | Choose insurers with fast, simple claims settlement. |

Premiums | Compare policies for affordable coverage. |

Risk Assessment | Work with brokers to assess risks and customize coverage. |

Review your policy often and consult knowledgeable brokers. Regular updates help you adapt to changes and protect your assets. Stay proactive and revisit your insurance needs as your business grows.

FAQ

What is logistics insurance?

Logistics insurance protects your business from losses during shipping, storage, or delivery. You get coverage for cargo damage, theft, and liability. This insurance helps you recover money if something goes wrong.

How do you choose the right logistics insurance policy?

Start by listing your business risks. Match coverage to your needs. Compare providers, check policy exclusions, and ask your broker for advice. Always review your policy as your business grows.

Does logistics insurance cover international shipments?

Yes, many logistics insurance policies cover international shipments. You must check your policy for specific regions and rules. Some areas may need extra coverage or have special requirements.

What should you do if you need to file a claim?

Contact your insurance provider right away.

Gather all documents, such as shipping records and photos of the damage.

Follow your provider’s instructions to complete the claim process quickly.

See Also

Choosing The Right Warehousing And Fulfillment For Your Business

Enhancing Global Operations With Innovative Logistics Strategies

Key Strategies For Effective Global Logistics Management

Streamlining Supply Chains With American Logistics Solutions

Optimizing Inventory And Distribution Through Global Logistics Warehousing