West Coast Freight Rates See Sharp Shifts with PGL

You face some of the sharpest rate shifts in west coast freight operations by pgl this year.

Rates dropped 21.2% from $2,744 to $2,162 per FEU.

Overall, West Coast freight rates fell about 25%, driven by weaker demand and increased carrier capacity.

International shipment volumes plunged 31.0% from July to August 2025.

Such volatility directly impacts your planning and costs, making rate monitoring more critical than ever.

Key Takeaways

Monitor freight rates closely. Rates can change rapidly, impacting your shipping costs and planning.

Prepare for sudden rate hikes. Carriers may use General Rate Increases (GRIs) and blank sailings to control supply and drive up prices.

Negotiate effectively. Use long-term contracts and volume-based discounts to secure better rates and manage costs.

Stay informed about regulatory changes. New fees and policies can affect your shipping expenses and routes.

Adapt your shipping strategies. Early planning and flexibility help you navigate market shifts and avoid unexpected costs.

2025 Rate Changes

Recent Drops

You have seen a sharp drop in freight rates this year. Rates fell by 15%, reaching $1,853 per FEU. This marks the lowest level since December 2023. Weak demand continues to pressure the market. Carriers responded by canceling about 13% of scheduled sailings across the Pacific. These blank sailings aim to balance the oversupply of shipping space. Ongoing tariff uncertainties between the US and China add to the volatility. You must watch for sudden changes in trade policy, as these can quickly shift the market.

Rates dropped 15% to $1,853 per FEU.

This is the lowest point since December 2023.

Carriers canceled 13% of sailings to manage excess capacity.

Tariff risks between the US and China remain high.

September Surge

September brought a sudden spike in rates. Carriers imposed a General Rate Increase (GRI) of $800–$900 per FEU. This move caused Asia–US West Coast rates to jump by 20.95% in just one week. You likely noticed a $400–$500 surge per FEU in early September. Carriers created artificial space shortages by blanking sailings, making it harder for you to secure slots. The GRI round announced on September 15 signaled more increases ahead, with further hikes planned for October 1.

Evidence Type | Details |

|---|---|

GRI Shock | Carriers imposed a GRI of $800–$900/FEU. |

Spot Rate Jump | Asia–US West Coast rates rose 20.95% week-over-week. |

Carrier Strategy | Driven by deliberate space scarcity. |

Slot Scarcity | Artificial space shortages through blank sailings. |

GRI Timeline | New GRI round announced on September 15. |

Future Increases | Further increases planned for October 1. |

Note: You should prepare for sudden rate hikes during peak periods. Carriers may use GRIs and blank sailings to control supply and drive up prices.

Current Benchmarks

As of October 2, the average spot rate from the Far East to the US West Coast stands at $1,681 per FEU. This is down 8% from the end of August. The Shanghai Containerized Freight Index (SCFI) rose 13.8% during the September surge, but rates remain well below last year’s peak season. You need to track these benchmarks closely. They help you plan your shipping budgets and negotiate contracts. West coast freight operations by pgl reflect these trends, showing how quickly the market can shift.

October 2 spot rate: $1,681 per FEU (down 8% from August end)

SCFI rose 13.8% during September

Rates remain lower than last year’s peak

You face a volatile market. Rates can swing by hundreds of dollars in a matter of weeks. Staying informed helps you make better decisions and manage your shipping costs.

West Coast Freight Operations by PGL

Market Drivers

You see several forces shaping west coast freight operations by pgl in 2025. The market shows excess truck availability, which means you have more choices but also face unpredictable rates. Government policies and economic conditions play a big role in demand and efficiency. Trade policies, especially tariffs, can quickly change freight flows and rates. When tariffs shift, you notice immediate changes in shipping costs and available routes. Geopolitical tensions, such as those between the US and EU, weaken trade relationships and add uncertainty. Military conflicts in the Middle East disrupt shipping lanes, causing higher freight costs. Drought in the Panama Canal reduces shipping capacity, forcing carriers to reroute and adjust schedules. You must stay alert to these changes because they can affect your shipping plans overnight.

Service Adjustments

You experience frequent service adjustments as pgl responds to market volatility. Blank sailings, where carriers cancel scheduled trips, create artificial space shortages. This strategy helps balance supply and demand but can delay your shipments. US ports, especially LA and Long Beach, face congestion and chaos due to shifting cargo patterns and tariff avoidance. Ships often wait 7 to 10 days for processing, which impacts your delivery timelines. Warehouse rental costs near ports have surged by over 30% in just one month because of these inefficiencies.

Evidence Type | Details |

|---|---|

Port Operations Under Strain | US ports are experiencing chaos and congestion due to shifts in cargo movement and tariff avoidance, leading to processing delays. |

Bottlenecks | Ships are facing significant delays of 7 to 10 days at major ports like LA and Long Beach. |

Cost Impacts | Warehouse rental costs near ports have surged by over 30% in one month due to logistics inefficiencies. |

Freight Rate Volatility | Spot rates have decreased despite reduced supply, with Drewry’s WCI falling 3% week-over-week. |

You also need to watch for new service fees. On October 14, 2025, pgl introduced fees for China-related shipments. These fees affect your costs and planning.

Fee Type | Amount (Starting) | Amount (By April 2028) |

|---|---|---|

Chinese-owned vessels | $50 per net ton | $140 per ton |

Non-Chinese using Chinese-built | $18 per ton or $120 per container | $33 per ton or $250 per container |

Compared to other providers, pgl offers daily runs, real-time data integration, flexible service options, and comprehensive route management. Competitors often provide basic services, limited technology, fixed schedules, and fewer truck types. You benefit from pgl’s advanced features, but you must adapt to frequent changes in service offerings.

Regulatory Impacts

You face new regulatory challenges in west coast freight operations by pgl. Stricter environmental rules require you to use cleaner technologies, which increases operational costs. These costs influence pgl’s pricing strategies and service decisions. US trade policy changes realign import patterns, affecting freight rates and your shipping options. Carriers feel financial pressure from falling rates and overcapacity, which regulatory changes make worse. This pressure shapes how pgl manages routes and sets prices.

Stricter environmental regulations increase operational costs.

US trade policy changes affect import patterns and freight rates.

Carriers face financial strain from falling rates and overcapacity.

Regulatory changes and supply chain disruptions shape operational decisions.

External economic factors also play a role. A temporary pause in tariffs led to a 70% spike in global freight index levels. New tariffs in early 2025 caused major disruptions in trade lanes. The market reacts quickly to policy changes, so you must prepare for volatility in ocean freight rates. Logistics managers recommend staying flexible and monitoring legal challenges and new fees.

Tip: Track regulatory updates and policy changes closely. Quick action helps you avoid unexpected costs and delays.

Trends and Comparisons

2023-2024 Patterns

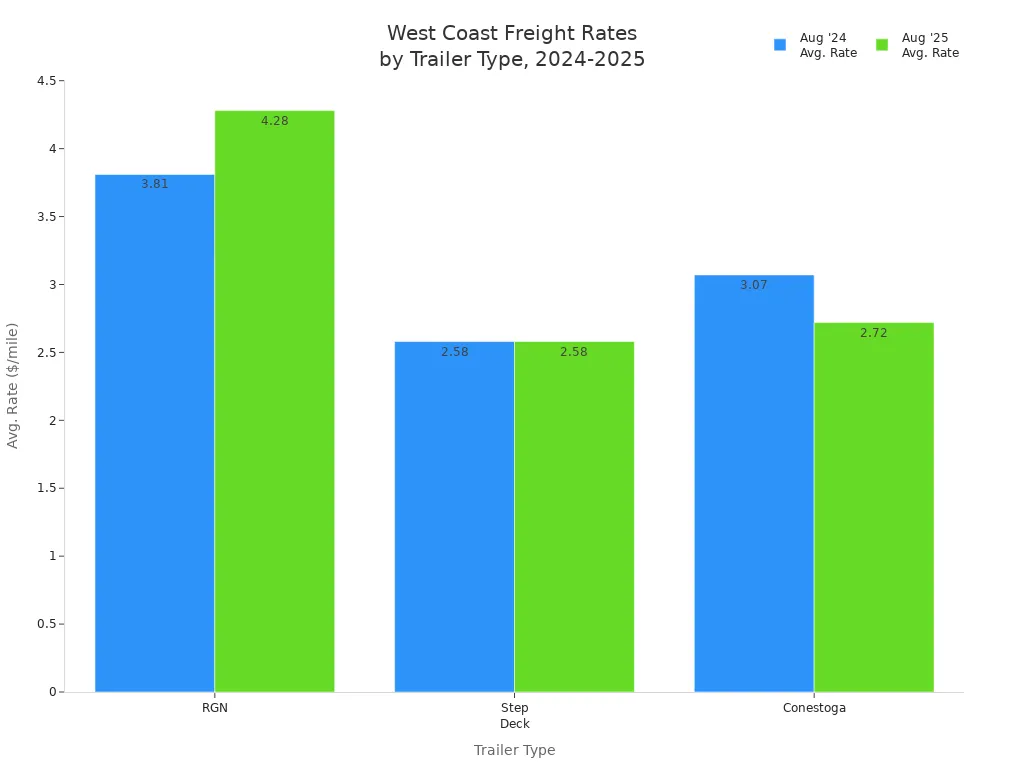

You saw many changes in freight rates over the past two years. Rates moved up and down, especially near the end of 2024. The dry van linehaul cost per mile in 2024 finished 4% lower than in 2023. This drop showed a clear downward trend in shipping costs.

Spot rates dropped sharply at the end of 2024.

Dry van linehaul costs fell 4% compared to 2023.

Market forecasts for 2025 predicted higher spot rates because of labor strikes and tariff threats.

You needed to watch these patterns closely. They helped you plan shipments and control costs.

2025 Differences

This year, you face new challenges in west coast freight operations by pgl. Seasonal changes in crops shift freight market dynamics. Cherry season in Washington ended, which eased capacity limits. Grape shipments moved from Arizona to California, raising inbound costs to Arizona. Outbound rates from Arizona dropped, but California saw higher costs for short-haul loads.

Spot pricing from the West Coast rises slowly before peak season.

Early shipment planning helps you avoid surge pricing.

Inbound freight to Southern California may see small spot market reductions.

Ocean container spot rates keep falling after peak season.

Transpacific rates to the West Coast fell 16% to $1,554 per FEU, much lower than last year.

Rates now sit at or near their lowest since before the Red Sea crisis.

You must adjust your shipping strategies to handle these changes. Planning early and tracking market shifts helps you save money.

Industry Response

You notice the industry reacting quickly to sharp rate shifts. Ocean container rates from Asia to U.S. coasts have dropped for five straight weeks. West Coast rates fell about 25% because of weak demand and more carrier capacity. Shipping rates from China to the U.S. West Coast dropped 68% since their peak in June. Lower U.S. orders and softer consumer demand caused this decline.

The Port of Los Angeles set a record in September, moving over 950,000 TEUs. This number marked a 27% increase from last year. Companies responded by adapting operations and using technology to improve efficiency. You see many businesses focus on cost management and service quality.

Tip: Stay flexible and invest in digital tools. Adaptability and smart planning help you manage future rate changes.

Impact and Actions

Shipper Costs

You face new cost pressures as west coast freight operations by pgl shift in 2025. The market expects a 7% increase in West Coast capacity in September compared to August. This extra space means carriers compete harder for your cargo, often leading to lower spot rates. If you ship high volumes, you can secure better pricing and longer agreements at favorable rates.

You may see lower spot rates as capacity rises.

High-volume shippers often get more competitive deals.

Extended contracts can help you lock in savings.

To manage costs, focus on these strategies:

Consolidate shipments to lower per-unit costs.

Select the right shipping mode for each load.

Negotiate with carriers using your volume as leverage.

Use technology to compare rates and track shipments.

Negotiation Strategies

You need strong negotiation tactics to handle volatile rates.

Use index-based contracts that tie your rates to market indices. This reduces the need for constant renegotiation.

Evaluate offers based on your risk tolerance and market trends.

Consider index-linked contracts that adjust with the market.

Work with multiple carriers to spread risk and ensure capacity.

Combine long-term contracts for base volumes with spot market options for surges.

Prioritize flexible service levels and negotiate volume-based discounts.

Set clear rules for surcharges.

Tip: A multi-carrier approach gives you more options and helps you avoid disruptions.

Adaptation Tips

You can adapt to shifting rates by staying proactive.

Watch for peak and demand surcharges throughout the year.

Adjust for fuel index changes and late payment fees.

Connect with industry experts for advice on parcel economics.

Stay updated on policy and economic changes in freight.

Avoid relying on just one or two carriers.

Partner with third-party logistics providers for better capacity and routing.

Diversify suppliers and distribution hubs.

Manage inventory to avoid just-in-time risks.

Staying flexible and informed helps you control costs and keep your supply chain running smoothly.

Outlook

Short-Term Forecast

You can expect a period of cautious optimism in the short term. Analysts see spot rates on the West Coast rising gradually. Seasonal freight and inventory restocking will likely drive this increase. You may notice more shipments as retailers prepare for holiday demand. However, port volumes remain unpredictable. Sudden changes in cargo flow could disrupt rate stability. You should watch for quick shifts in the market. Staying alert helps you respond to new opportunities and risks.

Long-Term View

Looking beyond 2025, you will see the freight market move toward stability. Several factors will shape your experience:

The market should stabilize with a slow, cautious recovery.

Cost pressures and new technology will continue to change how you operate.

Infrastructure upgrades from the Infrastructure Investment and Jobs Act (IIJA) will improve efficiency over time.

Global events, such as port congestion and labor issues, may still cause disruptions.

You will need to adapt as these trends unfold. Planning ahead gives you an advantage.

Stakeholder Advice

You face important choices when managing contracts and costs. Each option brings its own risks and rewards. The table below helps you compare short-term and long-term contracts:

Contract Type | Flexibility | Cost Implications | Risk of Unfavorable Rates | Opportunity for Savings |

|---|---|---|---|---|

Short-Term | High | Generally Higher | Low | Potentially Missed |

Long-Term | Low | Potentially Lower | High | Secured Savings |

Tip: You should balance flexibility with cost savings. Use a mix of contract types to manage risk. Stay informed about market trends and adjust your strategy as needed. This approach helps you protect your business and find new opportunities in a changing market.

You have seen how West Coast freight rates in 2025 shift quickly due to supply, demand, and global events. Staying alert helps you avoid extra costs and plan better.

Factor Influencing Freight Rates | Explanation |

|---|---|

Supply and Demand | Freight rates change quickly due to market conditions and trends. |

Seasonal Changes | Shipping peaks are starting earlier and lasting longer, leading to higher rates. |

Geopolitical Events | Unexpected global events can significantly impact carrier prices. |

To stay ahead, you should:

Monitor rates using tools like the TrueFreight Index and FreightWaves Insights.

Use both established and new strategies, such as long-term contracts and scenario planning.

Stay flexible and ready to adapt as the market changes.

Staying proactive keeps your shipping costs under control and your business competitive.

FAQ

What causes sudden changes in West Coast freight rates?

You see rates change quickly because of demand shifts, carrier capacity, and global events. Carriers may cancel sailings or add fees. Trade policies and weather disruptions also play a big role.

How can you secure better freight rates with PGL?

You can negotiate long-term contracts, ship higher volumes, and plan shipments early. Using digital tools to compare rates helps you find the best deals.

What is a General Rate Increase (GRI)?

A General Rate Increase (GRI) means carriers raise shipping prices for all customers. You often see GRIs during peak seasons or when carriers want to balance supply and demand.

How do new service fees affect your shipping costs?

New service fees, like those for China-related shipments, increase your total shipping expenses. You need to track these fees and adjust your budget to avoid surprises.

See Also

Streamlined West Coast Trucking Solutions for Today's Supply Chains

Three Strategies to Cut Costs with PGL Trucking Services

Reliable East Coast Trucking Solutions for Safe Goods Transport

Effective Trucking Solutions for U.S.-Canada and U.S.-Mexico Routes