What Are the Main Types of Logistics Insurance Coverage

You can find several logistics insurance coverage types that help protect goods while they move or stay in storage. The table below shows the most common types and what they cover:

Type of Insurance | Description |

|---|---|

Marine Cargo Insurance | Protects items moved by sea or rivers from risks like sinking or water damage. |

Air Cargo Insurance | Covers goods sent by air against mishandling, theft, or turbulence. |

Land Cargo Insurance | Shields goods on trucks or trains from accidents or theft. |

Warehouse-to-Warehouse Insurance | Offers full protection from the starting point to the final destination. |

Liability Insurance | Pays for legal costs and damages if logistics workers or vehicles cause an accident. |

You need to understand these options to keep your shipments and stored goods safe from loss or damage.

Key Takeaways

Understand the main types of logistics insurance, including cargo, marine, air, and warehouse insurance, to protect your goods effectively.

Choose the right cargo insurance policy based on your shipment's value and risks. Options include all-risk, named perils, and total loss only policies.

Review your insurance policy for exclusions, such as inherent vice or improper packaging, to avoid surprises when filing claims.

Work with knowledgeable insurance providers who can help you assess risks and find coverage that fits your business needs.

Keep detailed records of shipments and notify your insurer promptly if damage occurs to ensure a smooth claims process.

Logistics Insurance Coverage Types

You need to understand the main logistics insurance coverage types to protect your goods during shipping and storage. Most logistics companies use a mix of these insurance options to cover different risks. About 60% of logistics companies have tailored their insurance to address cargo, transit, and liability risks.

Here are the main categories of logistics insurance coverage types:

Type of Insurance | Description |

|---|---|

Cargo insurance | Covers goods from loading until delivery. |

Carrier liability insurance | Covers the carrier's legal responsibility for goods, limited by international conventions. |

Marine insurance | Covers goods transported by sea against risks like sinking, collision, fire, or piracy. |

Air freight insurance | Covers damage, loss, delays, and weather-related impacts for air transport. |

Warehouse insurance | Covers goods while in storage before or after transport. |

You can choose from several subtypes and policy options, such as all-risk, named perils, total loss, contingent, and legal liability. These options help you match coverage to your specific shipping needs.

Cargo Insurance Types

Cargo insurance is one of the most important logistics insurance coverage types. You use cargo insurance to transfer the financial risk of loss or damage during transit to an insurance company. This insurance covers theft, damage, loss, natural disasters, and accidents during shipping. The global cargo insurance market is growing fast, expected to reach over USD 65 billion by 2034.

You can select from different cargo insurance policies:

All-Risk Cargo Insurance: Covers almost every risk except those specifically excluded.

Named Perils Insurance: Protects against only the risks listed in the policy, such as fire or collision.

Total Loss Only Insurance: Pays out only if the entire shipment is lost.

Contingent Cargo Insurance: Provides coverage if the primary insurance fails to pay.

Type of Cargo Insurance | Coverage Options | Coverage Limits |

|---|---|---|

Land/Haulier Cargo Insurance | All-Risks Coverage, Named Perils Coverage, Carrier Liability | All-Risks is most comprehensive, Carrier Liability is limited |

Marine Cargo Insurance | Institute Cargo Clauses (A, B, C), War Risks and Strikes Insurance | Clauses A offers all-risk, B offers intermediate, C offers basic coverage |

Air Cargo Insurance | All-Risks Coverage, Named Perils Coverage, Delay Coverage | All-Risks is comprehensive; Named Perils is limited; Delay Coverage is optional |

You need to pick the right policy based on your cargo type, route, and risk level.

Carrier Liability Insurance

Carrier liability insurance is another key part of logistics insurance coverage types. This insurance covers the legal responsibility of carriers for goods in their care. Carrier liability is limited by international conventions and national laws. You must prove the carrier was negligent to make a claim.

Mode of Transport | International Conventions | National Laws |

|---|---|---|

Air | Warsaw Convention, Montreal Convention | N/A |

Road | CMR | N/A |

Rail | COTIF | N/A |

Ocean | Hague-Visby Rules, COGSA | U.S.: COGSA, U.K.: Carriage of Goods by Sea Act 1992, China: Maritime Code |

Carrier liability insurance usually excludes events outside the carrier's control, such as natural disasters or errors by the shipper. Coverage limits are often much lower than the actual value of the cargo.

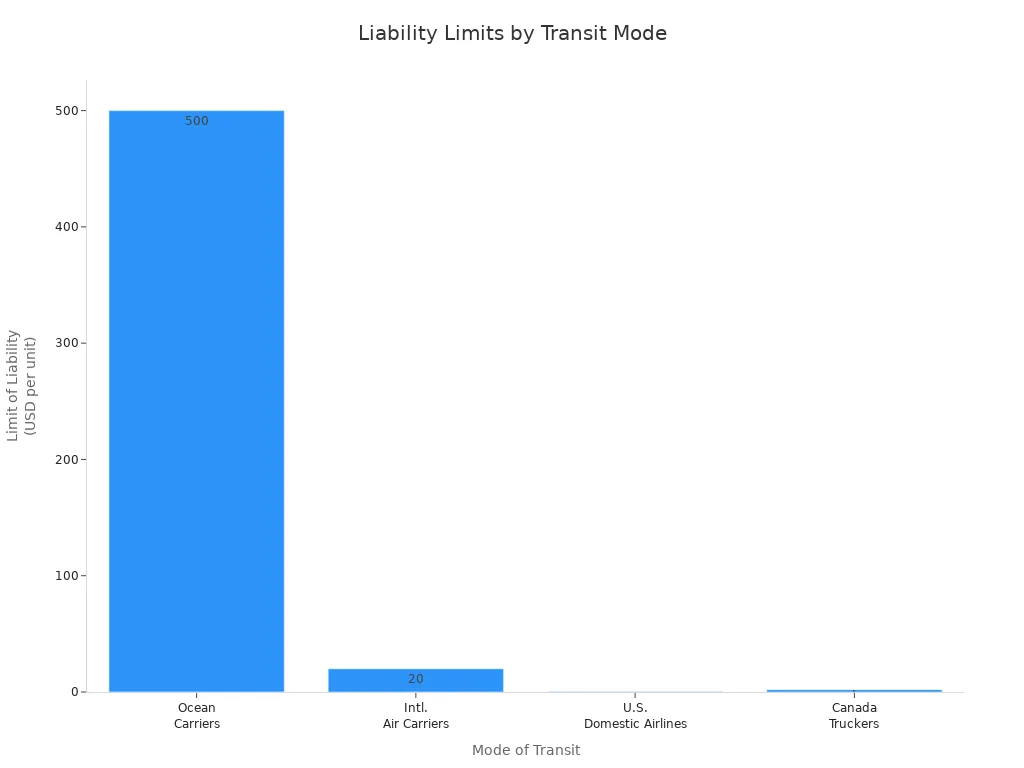

For example, ocean carriers may limit liability to $500 per package, while air carriers may limit it to about $20 per kilogram. You should always check these limits before shipping.

Marine Insurance

Marine insurance protects goods transported by sea. You need marine insurance if you ship products across oceans or rivers. This insurance covers risks like sinking, collision, fire, piracy, and heavy weather. Marine insurance policies use different clauses, such as Institute Cargo Clauses A, B, and C. Clause A gives you all-risk coverage, while B and C offer more limited protection.

Type of Insurance | Coverage Description | Common Perils Covered |

|---|---|---|

All-Risk Insurance | Comprehensive coverage for a wide range of perils. | Sinking, Burning, Stranding, Collision, Explosion, Heavy weather, Breakage or leakage, Non-delivery, Theft, and more. |

Named Perils Insurance | Covers only specific risks explicitly listed in the policy. | Burning, Sinking, Collision, Stranding |

You should choose marine insurance if your shipments face high risks at sea.

Air Freight Insurance

Air freight insurance covers goods shipped by air. You need this insurance for time-sensitive or high-value shipments. Air cargo insurance protects against damage, loss, delays, and weather-related impacts during flight. Insurance rates for air cargo are usually lower than marine shipping, even though air transport costs more.

Common causes of air freight claims include:

Freight damage

Shortages

Loss of entire shipments

Incorrect container selection

Poor packaging or labeling

Handling errors

Environmental factors

Air freight insurance is designed for goods transported by air and covers risks unique to air travel, such as turbulence or mishandling during loading.

Warehouse Legal Liability

Warehouse legal liability insurance protects goods stored in warehouses. You need this insurance if you store products before or after transport. Warehouse operators must provide a standard of care for stored goods. They are liable for damage caused by negligent handling, poor climate control, facility problems, employee mistakes, or cybersecurity failures.

Common claims under warehouse legal liability insurance include:

Claim Type | Description |

|---|---|

Damage or loss of fixtures and equipment | Coverage for direct physical damage to fixtures and equipment in leased buildings, up to $25,000. |

Earned storage and freight charges | Coverage for up to $25,000 for earned storage and freight charges that cannot be collected due to a loss. |

Debris removal and pollution cleanup | Coverage for debris removal and pollution cleanup, up to $50,000 or 25% of the loss amount. |

Losses due to change in temperature or humidity | Coverage for losses due to temperature or humidity changes, up to $50,000. |

Missing property | Coverage for missing property, providing up to $50,000 for unexplained losses. |

You may also get coverage for defense costs, fraud, earned warehouse charges, spoilage, and processing endorsements. Warehouse operators face risks like fire, theft, and damage to third-party cargo. They have a legal obligation for any loss or damage to goods in their care.

Tip: Always review your warehouse insurance policy to make sure it covers the risks your business faces.

You can see that logistics insurance coverage types offer many ways to protect your goods. You need to match your insurance choices to your shipping methods, storage needs, and risk level.

Cargo Insurance Policies

When you choose cargo insurance, you need to understand the main policy types. Each policy offers different protection for your shipments. The right choice depends on your cargo, route, and risk level.

All Risk Policy

All risk policies give you the broadest protection. You get coverage for almost every type of loss or damage, except for risks that the policy excludes. This policy works best for high-value goods, sensitive items, or shipments that travel through risky areas. You can feel confident that your cargo has strong protection.

Tip: All risk policies usually cost more because they cover more risks. The value of your goods, the route, and your claim history can affect the premium.

Named Perils Policy

Named perils policies only cover the risks listed in the policy. You might see coverage for fire, collision, or theft. If a risk is not named, you do not get coverage for it. This policy suits lower-value goods or shipments where you worry about specific dangers.

You pay less for named perils policies.

You need to check the list of covered risks before you buy.

Total Loss Only Policy

Total loss only policies protect you if your entire shipment is lost. You do not get paid for minor damage or partial loss. This policy works well for low-value goods, sturdy items, or shipments on safe routes.

Type of Insurance | Coverage Scope | Suitability |

|---|---|---|

All Risk | Covers all perils except those specifically excluded. | High-value, sensitive, or high-risk shipments. |

Named Perils | Covers only the perils specifically named in the policy. | Lower-value goods or specific risks. |

Total Loss Only | Protects against total loss of the shipment, not minor damages. | Low-value, resilient, or low-risk shipments. |

Contingent Cargo | Provides coverage when the primary policy does not respond. | International, unreliable carriers, or complex supply chains. |

Contingent Policy

Contingent cargo policies act as a safety net. You use this policy when your primary insurance does not pay. This coverage helps with international shipping, complex supply chains, or when you work with carriers that may not have reliable insurance.

Note: The cost of each policy depends on many factors. These include shipment value, mode of transport, destination, packaging, handling, and your claim history. If you use good risk management practices, you may pay less for insurance.

You need to match your policy choice to your needs. When you understand logistics insurance coverage types, you can protect your business and avoid costly mistakes.

Key Exclusions and Claims

Common Exclusions

When you buy logistics insurance, you need to know what is not covered. Insurance companies list exclusions to protect themselves from certain risks. If you understand these exclusions, you can avoid surprises when you file a claim.

Here are some of the most common exclusions you may find:

Inherent vice: Damage caused by the nature of the product itself, like fruit spoiling.

Latent defect: Damage due to poor quality or hidden flaws in the goods.

Loss due to improper packaging: Damage that happens because you did not pack or crate items correctly.

Willful misconduct by assured: Losses caused by intentional actions or fraud.

Unexplained loss or shortage: Goods that disappear or get stolen without clear evidence.

Hauling hazardous materials: Transporting dangerous items not covered by your policy.

Driving beyond allowed distance: Taking goods farther than the policy allows.

Driving too many miles in a day: Exceeding daily limits set by the insurer.

Using an uncovered truck: Using vehicles not listed in your insurance policy.

Driving on restricted roads: Using routes that your policy does not cover.

Tip: Always read your policy carefully. Ask your insurance provider about any exclusions that may affect your shipments.

Claims Process

If your goods get damaged or lost, you need to file a claim to get compensation. The claims process can be simple or complex, depending on the situation. Straightforward claims may take only a few weeks. More complicated cases could take months to resolve.

To file a claim, you must gather important documents. Here is a table showing what you usually need:

Document Type | Description |

|---|---|

Bill of Lading (BOL) | Receipt for goods, contract of carriage, includes shipper and consignee information. |

Commercial Invoice | Shows transaction details, goods description, and value. |

Packing List | Lists all packages and contents in the shipment. |

Damage Report or Survey | Third-party assessment of damage, with details about the loss. |

Photographs or Video Evidence | Visual proof of damage, showing different angles and context. |

Claim Letter | Formal letter with shipment details, loss description, and amount claimed. |

Proof of Value | Documents showing the value of goods, like invoices or repair estimates. |

You may also need the original bill of lading, paid freight bill, and inspection reports. Make sure you keep all records and take photos if you notice damage.

Note: The faster you provide complete documents, the quicker your claim may be processed.

If you know the exclusions and follow the claims process, you can protect your business and make sure you get the coverage you expect from your logistics insurance.

Choosing the Right Coverage

Assessing Your Needs

You need to start by looking at your business and the risks you face. Make sure you understand your responsibilities and the limits of liability in your contracts. Some contracts may need more coverage than usual. Always use your legal company name on policies to avoid confusion. You should know if your policy pays you directly or only covers losses after you pay. Stay up to date with reporting rules so you do not lose coverage.

Here is a checklist to help you assess your needs:

Review all contracts for special insurance requirements.

Confirm your company name matches on all documents.

Check if your policy is indemnity or direct pay.

Keep up with reporting deadlines.

Understand your liability limits.

Tip: Businesses often forget to arrange the right insurance for cargo. This can lead to big losses if something goes wrong.

Comparing Policy Options

You need to compare different policies before you choose one. Look at how you ship your goods. The mode of transportation changes the risks and the price. Where your goods start and end also matters. Some places have more risk because of politics or poor roads. The level of coverage you pick affects your costs. All-risk policies cost more but protect you better. Deductibles and limits change how much you pay out of pocket. Good packaging and security can lower your premium. Your claims history also affects your future costs.

Factor | What to Check |

|---|---|

Mode of Transportation | Truck, ship, air, or rail |

Origin and Destination | Risky routes or safe areas |

Level of Coverage | All-risk, named perils, total loss only |

Deductibles and Limits | Amount you pay before insurance starts |

Packaging/Security | Discounts for strong packaging or security |

Claims History | Past claims can raise your premium |

Note: Many business owners underestimate how much coverage they need. Some pick general policies and ignore special options. Others forget to update their policies as their business grows.

Working with Providers

You should work with insurance providers who know your industry. Ask questions about the differences between policies. Make sure you understand what each policy covers. Providers can help you spot risks in your operations. They can explain the best options for your business. Do not choose a policy just because it is cheap. Look for coverage that matches your needs.

Ask about coverage for your specific risks.

Check if the provider offers help with claims.

Make sure you understand all terms and exclusions.

Tip: Not knowing the differences between insurance types can lead to picking the wrong policy. Always ask for clear explanations.

Choosing the right logistics insurance protects your business from costly losses. If you select inadequate coverage, you risk underinsured shipments, higher claims costs, and even catastrophic financial strain. To avoid common mistakes, you should:

Keep detailed records for every shipment.

Notify your insurer quickly if damage occurs.

Use strong packaging and inspect goods on arrival.

Review your policy limits, understand exclusions like inherent vice or shipper’s negligence, and ask an insurance professional for advice. Careful planning helps you avoid surprises and keeps your business secure. 🚚

FAQ

What is the difference between cargo insurance and carrier liability insurance?

Cargo insurance protects your goods from most risks during shipping. Carrier liability insurance only covers losses if the carrier is at fault. You get more protection with cargo insurance.

Do you need insurance for every shipment?

You should have insurance for every shipment. Accidents, theft, or damage can happen at any time. Insurance helps you avoid big financial losses.

What happens if your claim gets denied?

If your claim gets denied, review the reason with your insurer. Check if you missed documents or if the loss falls under an exclusion. You can ask for a review or appeal.

How can you lower your logistics insurance premium?

Use strong packaging.

Choose safe routes.

Keep a good claims history.

Work with trusted carriers.

These steps help you reduce your insurance costs.

See Also

Key Strategies for Effective Global Logistics Operations

Comprehensive Overview of East Coast B2B Logistics Services

Enhancing Global Operations Through Innovative Logistics Strategies

Streamlined Inventory Management and Distribution with Premier Logistics

Dynamic Trucking Solutions for West Coast Freight by Premier Logistics