Regional logistics comparison Chicago vs Atlanta made easy

Chicago holds the top spot in regional logistics, driven by its unmatched freight traffic and intermodal connections. The city’s central location and strong infrastructure give it a clear edge for moving goods efficiently across the country. Recent industry reports show that 25% of all freight trains and half of intermodal trains pass through Chicago, reinforcing its status as a logistics powerhouse. In the regional logistics comparison chicago vs atlanta, Chicago’s advantage lies in its ability to connect major markets with speed and reliability.

Key Takeaways

Chicago is a logistics leader due to its central location and extensive rail network, making it ideal for national distribution.

Atlanta excels in cost efficiency and has strong access to major highways and the Port of Savannah, supporting quick shipping.

Both cities have invested heavily in infrastructure, but Chicago focuses on rail and intermodal capacity while Atlanta emphasizes road and air transport.

Companies should assess their specific logistics needs and market goals to choose the best city for their operations.

Investments in workforce training and technology in both cities help logistics firms adapt to changing demands and improve efficiency.

Regional logistics comparison Chicago vs Atlanta

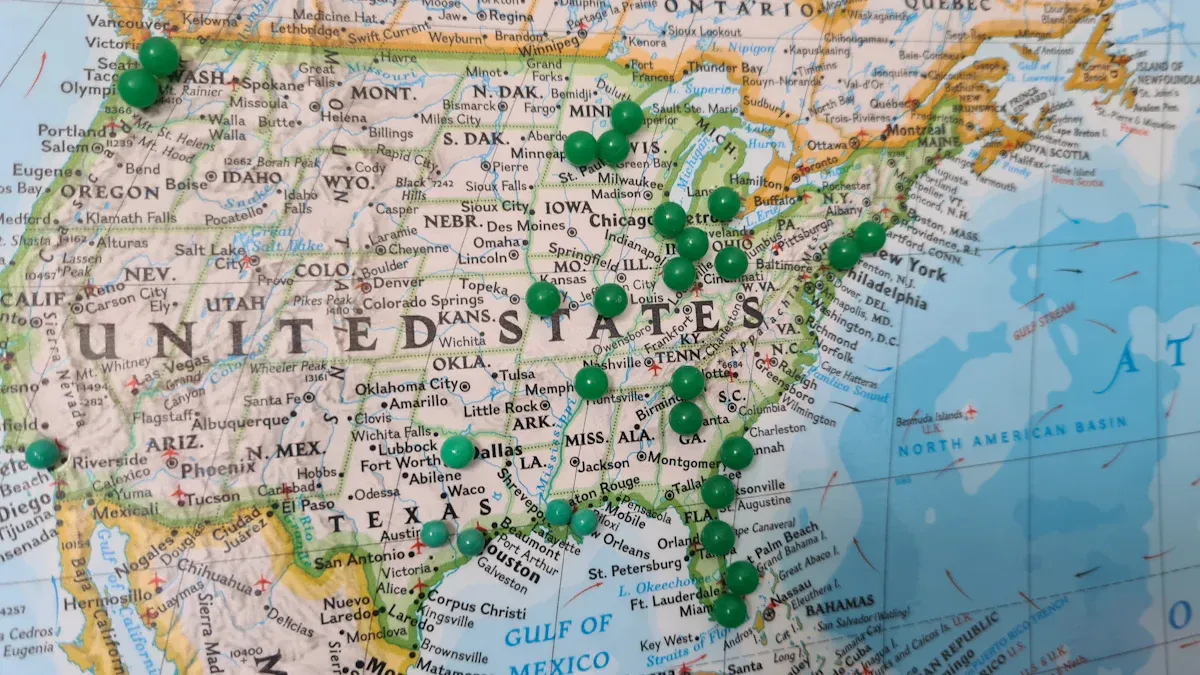

Chicago and Atlanta both stand out as leading logistics hubs in the United States. Each city has built a reputation for moving goods quickly and efficiently. Their strategic locations and investments in infrastructure have made them top choices for companies looking to distribute products across the country. In the regional logistics comparison chicago vs atlanta, both cities offer unique strengths that support their logistics sectors.

Chicago: Infrastructure strengths

Chicago’s infrastructure forms the backbone of its logistics dominance. The city sits at the crossroads of the nation’s rail and highway systems. Six of the seven Class I railroads converge in Chicago, making it the largest intermodal hub in the country. About 25% of all U.S. freight rail traffic passes through Chicago. The city’s extensive rail yards and highway network connect businesses to every major market in North America.

Chicago’s O’Hare International Airport supports international trade with modern cargo terminals and advanced handling facilities. This airport processes large volumes of air cargo, helping companies move goods quickly around the world.

Recent investments have strengthened Chicago’s position as a logistics leader. The city leads the nation in Bipartisan Infrastructure Law (BIL) funding for future growth. In 2023, Chicago received $414 million in grant funding, a 23% increase from the previous year. The city expects nearly $2 billion in future grants, including the largest in CTA’s history for the Red Line extension. These investments support projects like the CREATE Program, which modernizes rail infrastructure and increases capacity.

Strengths | Description |

|---|---|

Central Location | Connects major U.S. markets efficiently |

Extensive Rail Network | Six of seven Class I railroads, largest intermodal hub |

Air Cargo Capabilities | O’Hare International Airport with advanced cargo facilities |

Multimodal Connectivity | Rail, road, air, and maritime options for flexible shipping |

Industry Concentration | Diverse industries drive high cargo demand |

Strategic Trade Hub | Key transfer point for goods between Asia, Europe, and the Americas |

Infrastructure Investments | $63 billion in modernization and expansion projects |

Atlanta: Infrastructure strengths

Atlanta has built a powerful logistics network centered on flexibility and speed. The city’s location at the intersection of I-75, I-85, and I-20 allows trucks to reach 80% of the U.S. population within two days. This highway system reduces fuel and driver costs, making ground transport efficient.

Hartsfield-Jackson Atlanta International Airport stands as the world’s busiest airport, handling over 110 million passengers and more than 650,000 tons of cargo each year. The airport’s three cargo complexes support global shipping and premium freight services.

Atlanta’s rail network connects major lines for cross-country distribution. The city’s proximity to the Port of Savannah, just 250 miles away, gives businesses direct access to the fastest-growing container port on the East Coast. This connection supports international trade and intermodal efficiency.

Transportation Mode | Key Advantage | Market Reach | Cost Efficiency |

|---|---|---|---|

Interstate Highway System | Convergence of I-75, I-85, I-20 | 80% of US population in 2 days | Reduced fuel and driver costs |

Air Cargo | World’s busiest airport | Global connectivity | Premium shipping options |

Rail Freight | Major line intersections | Cross-country distribution | Bulk shipment savings |

Port Access | Proximity to Savannah | International trade routes | Intermodal efficiency |

According to logistics experts, Georgia’s logistics industry stands out for its complete mix of road, rail, air, and ocean transport. This modal agility gives manufacturers and shippers in Atlanta a strong advantage.

Infrastructure: Which city leads?

The regional logistics comparison chicago vs atlanta shows that both cities have invested heavily in infrastructure. Chicago leads in rail and intermodal capacity, with unmatched connections and ongoing modernization projects. Atlanta excels in highway access, air cargo volume, and proximity to a major port. Chicago’s central location and rail dominance make it the top choice for companies needing national reach and intermodal flexibility. Atlanta’s strengths in road, air, and port access give it an edge for businesses focused on the Southeast and international trade.

Feature | Chicago | Atlanta |

|---|---|---|

Largest Intermodal Hub | Yes | No |

Railroads Converging | 6 of 7 Class I railroads | Major line intersections |

Air Cargo Volume | High (O’Hare International) | Very High (Hartsfield-Jackson) |

Highway Network | Extensive | Interstate convergence |

Port Access | Great Lakes, Mississippi River | Close to Port of Savannah |

Infrastructure Investment | $63 billion, BIL leader | Fast-growing, DOT outlays |

Location and Market Reach

Chicago: Central U.S. access

Chicago sits in the heart of the Midwest. The city’s central location allows companies to reach major U.S. markets quickly. Businesses use Chicago’s extensive highway network, including Interstates 90 and 94, to ship goods to both coasts and throughout the Midwest. Rail infrastructure, such as Union Station and CSX’s Barr Yard, supports seamless multimodal transport. O’Hare International Airport and Midway Airport offer fast air freight options for urgent deliveries.

Impact on Delivery Times | |

|---|---|

Major Interstates | Enables fast shipping to all coasts and throughout the Midwest |

Rail Infrastructure | Provides seamless multimodal transport options for efficient distribution |

Airports | Facilitates quick air freight options for urgent deliveries |

Central location reduces shipping costs by 20-25%.

Proximity to interstates allows for 1-2 day delivery to 80% of the U.S. population.

Chicago’s role as a vital distribution center for the Midwest strengthens its market reach. Companies benefit from access to a diverse customer base and efficient delivery times.

Atlanta: Southeast market reach

Atlanta serves as a major transportation nexus in the Southeast. The city’s location provides access to key regional and national markets. Interstate highways 75 and 85 connect Atlanta to cities like Miami, Dallas, and Washington, DC within a day’s drive. Hartsfield-Jackson Atlanta International Airport supports global connectivity and generates a $34.8 billion economic impact.

Description | |

|---|---|

Experienced workforce | Georgia Tech produces logistics engineers, and the local workforce is skilled in distribution. |

3PL infrastructure | Major third-party logistics providers have operations in Atlanta. |

Technology integration | The local tech scene supports warehouse automation and software development. |

National reach | Atlanta is within a day’s drive of major cities like Miami, DC, Dallas, and Chicago. |

The city is a major hub for tech, restaurant, and entertainment industries.

Atlanta’s infrastructure supports access to a large portion of the U.S. population within a one-day drive.

Atlanta’s diverse population and strong business environment make it a key hub for regional logistics.

Market reach: Direct comparison

The regional logistics comparison chicago vs atlanta highlights differences in market accessibility. Chicago’s central location enables fast shipping to all major U.S. regions, especially the Midwest. Atlanta’s southeastern position offers quick access to the South and East Coast, with strong connections to national and international markets.

Chicago | Atlanta | |

|---|---|---|

Strategic Location | Heart of the Midwest | Major transportation nexus in the Southeast |

Major Airports | O’Hare International, Midway | Hartsfield-Jackson Atlanta International |

Rail Infrastructure | Major rail hubs | Intermodal rail facilities |

Highway Network | Extensive (Interstate 90, 94) | Extensive (Interstate 75, 85) |

Role in Logistics | Vital distribution center for the Midwest | Key distribution hub for the Southeast |

Both cities offer strong market reach, but Chicago excels in national distribution while Atlanta leads in southeastern and international access.

Cost and Efficiency

Chicago: Logistics costs and efficiency

Chicago offers competitive logistics costs for businesses. Warehousing rates in the city range from $6.50 to $9.50 per square foot each year. These rates are 15-20% lower than those in coastal markets. The city provides over 1.2 billion square feet of industrial space, which helps keep vacancy rates healthy at about 5.4%. This competitive environment benefits shippers and logistics companies.

Chicago’s central location reduces shipping costs by up to 25%. Rail freight in Chicago saves companies 10-15% compared to trucking. The city’s infrastructure supports efficient movement of goods, which minimizes delays and lowers operational expenses.

Category | Notes | |

|---|---|---|

Fuel Cost | $432.52 | Estimated from national average diesel price |

Driving Time | 10.8 hr | Time taken for the journey |

Driving Distance | 719 mi | Distance between cities |

Rail Freight Savings | 10-15% | Savings compared to trucking |

Atlanta: Logistics costs and efficiency

Atlanta provides a cost-effective environment for logistics operations. Base rental rates for industrial space range from $4.50 to $9.00 per square foot each year. Triple Net charges add $1.50 to $3.00 per square foot for property taxes, insurance, and maintenance. Labor costs average $15 to $22 per hour for warehouse workers. Utility expenses and build-out costs vary based on facility needs.

Atlanta’s location allows access to 80% of the U.S. population within a two-hour flight. The city sits close to 28 million people within a 300-mile radius. Major interstates and a vast rail network support efficient freight movement. Hartsfield-Jackson Atlanta International Airport handles over 650,000 metric tons of cargo each year, which boosts logistics efficiency.

Base rental rates: $4.50-$9.00/sq ft annually

Triple Net charges: $1.50-$3.00/sq ft annually

Labor costs: $15-$22/hour

Build-out costs: $5-$50/sq ft

Cost-effectiveness: Which city wins?

The regional logistics comparison chicago vs atlanta shows that both cities offer cost advantages. Chicago excels in warehousing affordability and rail freight savings. Atlanta stands out for lower labor costs and flexible facility expenses. Both cities benefit from strong infrastructure and strategic locations.

Factor | Description |

|---|---|

Logistics Planning | Monitoring market trends to predict demand and avoid bottlenecks. |

Capacity Management | Adjusting shipping strategies for seasonal demand. |

Mode Diversification | Using multiple shipping modes to reduce risk and increase reliability. |

Predictive Analytics | Forecasting capacity issues for better planning. |

Companies that optimize logistics planning and diversify shipping modes gain a competitive edge in both cities.

Workforce and Business Environment

Chicago: Workforce and support

Chicago offers a robust workforce for logistics companies. The city supports talent development through several programs. These initiatives help workers gain skills and connect with employers. Many organizations provide training, apprenticeships, and job placement services.

Program Name | Description |

|---|---|

A citywide movement providing career pathways for Chicagoans ages 14-24 through collaboration. | |

TDL Sector Center (YWCA) | Offers multiple employer and candidate services focused on training and job placement in logistics. |

Calumet Area Industrial Commission | Provides apprenticeships, on-the-job training, and job placement services for individuals in logistics. |

Prairie State College Workforce Development | Customized training in TDL, CDL, Manufacturing, and Supply Chain Management to meet industry needs. |

These programs address skill gaps and labor shortages. Companies in Chicago also benefit from partnerships with local colleges and workforce centers. This support helps logistics firms find qualified workers and keep up with technology changes.

Atlanta: Workforce and support

Atlanta’s logistics sector employs over 318,000 people in transportation roles. The workforce plays a critical role in the city’s economy. High demand for logistics services has increased competition for skilled workers. Atlanta addresses this need with strong training programs and business incentives.

Aspect | Details |

|---|---|

Workforce Size | Over 318,000 people in transportation roles |

Importance | Critical infrastructure for the economy |

Competition for Workers | Increasingly tight due to high demand |

Georgia Quick Start program provides customized workforce training at no cost to businesses.

HOPE Scholarship program offers merit-based financial aid to support skilled workforce development.

The state government supports logistics companies by improving infrastructure and reducing regulatory burdens. These efforts create a business-friendly environment for logistics operations.

Business environment: Comparison

Chicago and Atlanta both serve as major logistics hubs. Each city offers a diverse economy and strong support for logistics firms.

City | Key Features | Major Corporations Headquartered |

|---|---|---|

Chicago | Major transportation and logistics hub; diverse economy including finance, manufacturing, and technology. | Boeing, United Airlines, McDonald’s |

Atlanta | Strategic location as a transportation and logistics hub; growing film and entertainment industry. | Coca-Cola, UPS |

Logistics companies in both cities face challenges such as rising delivery costs, labor shortages, and the need for advanced technical skills. Many firms use training programs, flexible schedules, and technology upgrades to address these issues. Both Chicago and Atlanta continue to invest in their workforce and business environments to support future growth.

Industry Presence and Growth

Chicago: Major players and growth

Chicago stands as a powerhouse in the logistics industry. Many leading companies have established significant operations in the city. These organizations drive innovation and efficiency in freight movement.

Redwood Logistics

Bringg

Locusview

Arrive Logistics

MoLo Solutions

Sheer Logistics

Omni Logistics

New City Moving

Azteca Movers

WayFinder Logistics

The logistics sector in Chicago has grown rapidly. The city’s strategic location and robust infrastructure attract new investments. E-commerce has increased the demand for advanced logistics solutions. Chicago serves as a major inland freight hub. The industrial real estate market remains strong, supporting expansion. A skilled workforce helps companies adapt to new technologies and changing customer needs.

Atlanta: Major players and growth

Atlanta continues to build its reputation as a logistics center. The city’s location and access to multiple transport modes support growth. Many companies choose Atlanta for distribution and warehousing. The logistics industry in Atlanta benefits from a diverse economy and strong business incentives.

The job market shows steady growth. Warehouse jobs and production roles are expanding. Atlanta’s workforce supports the logistics sector with training programs and technology adoption.

Job Type | |

|---|---|

Warehouse Jobs | 3.2% |

Production Jobs | 2.2% |

Atlanta’s logistics industry expects continued expansion over the next five years. Companies invest in automation and supply chain management to meet rising demand.

Growth potential: Which city is better?

Chicago and Atlanta both offer strong growth prospects in logistics. Chicago leads with its established infrastructure and concentration of major players. The city’s position as a freight hub supports long-term expansion. Atlanta shows impressive growth rates in logistics jobs. The city’s access to the Southeast and international markets attracts new businesses.

Companies seeking national reach and advanced logistics solutions often choose Chicago. Businesses focused on southeastern markets and rapid job growth find Atlanta appealing.

Both cities provide opportunities for logistics firms to grow and innovate. The choice depends on business goals and market priorities.

The regional logistics comparison chicago vs atlanta shows that Chicago leads with its central location, advanced rail network, and strong infrastructure investments. Atlanta stands out for cost efficiency, port access, and rapid job growth. Companies seeking national reach and intermodal flexibility may prefer Chicago. Firms focused on southeastern markets or lower costs may choose Atlanta. Every business should assess its priorities before making a decision.

Tip: Review your supply chain needs and market goals to select the best logistics hub.

FAQ

What makes Chicago a top logistics hub?

Chicago connects major railroads, highways, and airports. The city’s central location allows fast shipping to all U.S. regions. Many companies choose Chicago for its advanced infrastructure and reliable freight movement.

How does Atlanta support international logistics?

Atlanta offers direct access to the Port of Savannah and Hartsfield-Jackson Atlanta International Airport. These connections help companies ship goods worldwide. The city’s highway network also supports fast ground transport.

Which city offers lower logistics costs?

Atlanta usually provides lower labor and facility costs. Chicago offers savings through rail freight and warehousing. Companies should compare their specific needs before choosing a location.

Can both cities handle e-commerce growth?

Both Chicago and Atlanta invest in technology and workforce training. These efforts help logistics companies manage rising e-commerce demand and improve delivery speed.

See Also

Simplifying Supply Chain Management With U.S. Logistics Expertise

Streamlined Freight Services Throughout The Southeastern United States

Rapid East Coast Shipping With PGL’s Miami Warehouse Solutions

Effective Warehousing Strategies From PGL In Key U.S. Locations

Time-Saving Drayage And Trucking Solutions From PGL In California